What Are Structured Settlement Payments?

Structured settlement payments are financial arrangements where a claimant receives periodic payments over time instead of a lump sum. These settlements are commonly used in personal injury, wrongful death, or workers’ compensation cases to ensure long-term financial stability for the recipient.

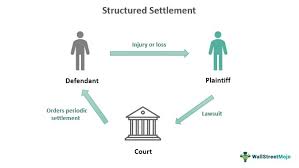

How Do Structured Settlements Work?

When a lawsuit results in a structured settlement, the defendant or their insurer agrees to pay the settlement amount through an annuity purchased from an insurance company. The annuity then distributes payments to the recipient according to a predetermined schedule, which can be monthly, annually, or customized based on the recipient’s needs.

Benefits of Structured Settlement Payments

1. Steady Income Stream

Structured settlements provide a reliable source of income, ensuring financial security for the recipient.

2. Tax Advantages

Unlike lump-sum payments, structured settlements are often tax-free, making them an efficient financial option.

3. Customized Payment Plans

Recipients can tailor payment schedules to align with their financial needs, such as education costs, medical bills, or retirement.

4. Protection from Poor Financial Decisions

Receiving money over time prevents reckless spending, ensuring long-term financial health.

Downsides of Structured Settlements

1. Lack of Liquidity

Once structured, settlements are rigid, making it difficult to access a large sum when needed.

2. Inflation Risk

If payments are not adjusted for inflation, the real value of the money may decrease over time.

3. Limited Investment Opportunities

Recipients miss out on potential higher returns from investments compared to a lump-sum payout.

Selling Structured Settlement Payments

In some situations, recipients may choose to sell their structured settlement payments for a lump sum. This process, known as structured settlement factoring, involves selling future payments to a third-party company at a discounted rate.

Reasons to Sell a Structured Settlement

- Medical emergencies

- Paying off high-interest debt

- Home purchase or investment

- Business opportunities

How to Sell Your Structured Settlement

- Evaluate Financial Needs: Determine why you need a lump sum and if selling your settlement is the best option.

- Research Buyers: Choose a reputable structured settlement purchasing company.

- Understand the Terms: Ensure you are getting a fair deal with competitive discount rates.

- Seek Court Approval: Structured settlement sales require judicial approval to protect recipients from unfavorable deals.

Choosing the Right Structured Settlement Buyer

To ensure a fair deal when selling structured settlement payments, consider the following:

- Reputation and Reviews: Check online ratings and customer feedback.

- Discount Rate: Lower discount rates mean you retain more of your money.

- Transparency: The company should provide clear terms with no hidden fees.

- Customer Support: A responsive and professional team ensures a smooth transaction.

Conclusion

Structured settlement payments offer financial security and stability, making them an ideal solution for long-term financial planning. However, if circumstances change, selling structured payments may be a viable option. Always research, consult financial experts, and consider all options before making a decision.

Frequently Asked Questions (FAQs)

1. Are structured settlement payments taxable?

No, structured settlement payments from personal injury cases are typically tax-free.

2. Can I sell part of my structured settlement?

Yes, you can sell a portion of your future payments while keeping the rest.

3. How long does it take to sell structured settlement payments?

The process can take 30-60 days, depending on court approval and buyer procedures.

4. What factors affect the lump sum offer for my settlement?

Discount rates, payment schedule, and market conditions influence the final offer.

By understanding structured settlement payments, their benefits, and the process of selling them, you can make informed financial decisions that align with your needs and goals.