When you run a business, protecting it from potential risks is crucial. One of the most effective ways to safeguard your company from financial losses due to lawsuits or claims is through business liability insurance. Whether you’re a small startup or an established corporation, choosing the right provider for your liability coverage is key. In this article, we will rank the top business liability insurance providers for 2025, based on factors such as customer satisfaction, coverage options, pricing, and overall service.

What is Business Liability Insurance?

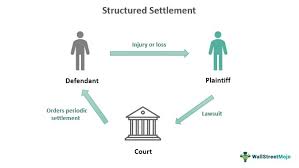

Business liability insurance helps protect your business from claims arising due to accidents, injuries, or negligence that occur during your day-to-day operations. It is designed to cover:

- General Liability: Covers legal costs and compensation for third-party injuries or damages.

- Professional Liability: Covers businesses offering professional advice or services in case of negligence or mistakes.

- Product Liability: Protects against claims related to defects in products you manufacture or sell.

- Employer’s Liability: Covers employee claims related to workplace injuries.

With so many business liability insurance providers to choose from, it can be difficult to know where to start. Below, we’ve ranked the best companies offering comprehensive coverage, excellent customer support, and flexible plans.

1. Hiscox: Best for Small to Medium-Sized Businesses

Why Choose Hiscox:

- Comprehensive Coverage Options: Hiscox is widely known for offering flexible liability insurance that fits small to medium-sized businesses, including general liability, professional liability, and errors and omissions (E&O) insurance.

- Tailored Plans: Hiscox allows business owners to customize their policies, making it easier to find the right coverage for various industries like technology, consulting, and construction.

- Easy Online Experience: Hiscox offers a streamlined online process for getting quotes and purchasing coverage quickly. The platform is user-friendly and easy to navigate.

Key Features:

- Fast quote process

- Flexible policies for various industries

- 24/7 customer service

Customer Satisfaction: 4.5/5 (based on online reviews)

Pricing: Competitive for small businesses, with policies starting as low as $22 per month.

2. The Hartford: Best for Comprehensive Coverage

Why Choose The Hartford:

- Extensive Coverage Options: The Hartford offers a wide array of business liability policies, including general liability, professional liability, and cyber liability, all under one roof.

- Risk Management Services: They provide robust risk management tools and services to help businesses minimize exposure to risks, which is a unique selling point for industries with higher risks.

- Strong Financial Stability: The Hartford has been in business for over 200 years and is highly regarded for its financial stability, which provides peace of mind to policyholders.

Key Features:

- Award-winning customer service

- Risk management resources

- Nationwide availability

Customer Satisfaction: 4.7/5 (based on online reviews)

Pricing: Pricing is higher but offers extensive coverage options for businesses in various sectors.

3. State Farm: Best for Established Businesses

Why Choose State Farm:

- Reputable Brand: State Farm is a trusted name in the insurance industry, known for offering a variety of liability policies with solid claims support.

- Customizable Coverage: Their business insurance policies are highly customizable, offering packages that allow businesses to bundle general liability and commercial property insurance.

- Local Agents: State Farm offers a personalized experience with agents who understand the unique needs of your industry.

Key Features:

- Customizable bundles

- Local agents with industry expertise

- Good claims handling reputation

Customer Satisfaction: 4.8/5 (based on online reviews)

Pricing: Competitive pricing with discounts for bundling policies.

4. Chubb: Best for High-Risk Businesses

Why Choose Chubb:

- Specialized Coverage for High-Risk Industries: Chubb specializes in providing tailored insurance for high-risk businesses, including those in the healthcare, manufacturing, and financial sectors.

- Global Reach: Chubb operates worldwide, offering international business liability insurance coverage for companies with a global footprint.

- Comprehensive Risk Management: Chubb provides in-depth risk management consultations and services, helping businesses manage their liabilities before they escalate.

Key Features:

- High-risk industry specialization

- Global coverage options

- Extensive claims handling expertise

Customer Satisfaction: 4.6/5 (based on online reviews)

Pricing: Premium pricing for high-risk businesses, but worth it for companies in need of specialized protection.

5. Next Insurance: Best for Digital Businesses & Freelancers

Why Choose Next Insurance:

- Affordable & Flexible Coverage: Next Insurance offers affordable and customizable liability insurance plans specifically designed for freelancers and small digital businesses. Whether you’re a freelancer, consultant, or small e-commerce business, Next Insurance has flexible policies.

- Quick & Easy Online Process: The entire process—from getting a quote to purchasing insurance—can be completed online in a matter of minutes.

- Industry-Specific Plans: Next Insurance offers tailored policies for a wide range of industries, including tech startups, construction, and fitness professionals.

Key Features:

- Fast, fully online process

- Tailored for freelancers and small businesses

- Affordable rates with policies starting as low as $19 per month

Customer Satisfaction: 4.5/5 (based on online reviews)

Pricing: Highly competitive and one of the best options for freelancers and small businesses.

6. Nationwide: Best for Customizable Policies

Why Choose Nationwide:

- Personalized Insurance Solutions: Nationwide is known for providing personalized insurance solutions to businesses of all sizes, with an emphasis on customization. Their policies can be adjusted to meet the specific needs of a wide range of industries.

- Comprehensive Liability Coverage: Nationwide offers various types of liability insurance, including general liability, workers’ compensation, and professional liability insurance.

- Additional Business Services: They provide a variety of additional services, such as business consulting and risk management tools, making it a one-stop-shop for business owners.

Key Features:

- Customizable plans

- Expert risk management support

- Broad industry coverage

Customer Satisfaction: 4.4/5 (based on online reviews)

Pricing: Flexible pricing options with competitive rates for medium and large businesses.

7. Travelers Insurance: Best for Large Businesses

Why Choose Travelers:

- Comprehensive Coverage for Large Enterprises: Travelers Insurance offers extensive liability coverage tailored to large businesses and corporations. Their packages cover everything from general liability to more specialized forms like environmental liability and product liability.

- Risk Control Services: Travelers is highly regarded for its risk management and loss prevention services, which help large businesses mitigate risks proactively.

- Long-Term Stability: With over 160 years in the industry, Travelers is known for its financial strength and reliability.

Key Features:

- Specialized coverage for large enterprises

- Extensive risk control services

- International presence for multinational businesses

Customer Satisfaction: 4.7/5 (based on online reviews)

Pricing: More expensive, but the cost is justified for larger businesses with complex liability needs.

Conclusion: Finding the Best Business Liability Insurance Provider

Choosing the right business liability insurance provider is essential for protecting your company from unexpected risks. Whether you’re a small freelancer or a large multinational business, the providers listed above offer various plans that can cater to your unique needs.

- Hiscox is great for small businesses needing affordable and flexible options.

- The Hartford excels in offering comprehensive coverage and risk management services.

- State Farm stands out for established businesses with customizable coverage and local agent support.

- Chubb is a top choice for high-risk businesses requiring specialized protection.

- Next Insurance is perfect for digital businesses and freelancers looking for quick, affordable coverage.

- Nationwide provides excellent customization for businesses of all sizes.

- Travelers is ideal for larger businesses seeking specialized, comprehensive protection.

Take the time to compare these providers, assess your specific needs, and make an informed decision to protect your business for years to come.

FAQs

1. What types of businesses need liability insurance? Nearly every business needs some form of liability insurance, especially those that interact with customers, provide professional services, or manufacture products. The specific coverage needed depends on the nature of your business.

2. How much does business liability insurance cost? The cost of liability insurance varies based on your business type, size, industry, and coverage needs. Small businesses may pay as little as $22 per month, while larger businesses or those in higher-risk industries may pay more.

3. Is business liability insurance mandatory? While liability insurance isn’t always legally required, it is highly recommended to protect your business from lawsuits and unexpected financial loss. In some cases, clients or contractors may require proof of liability insurance before working with you.